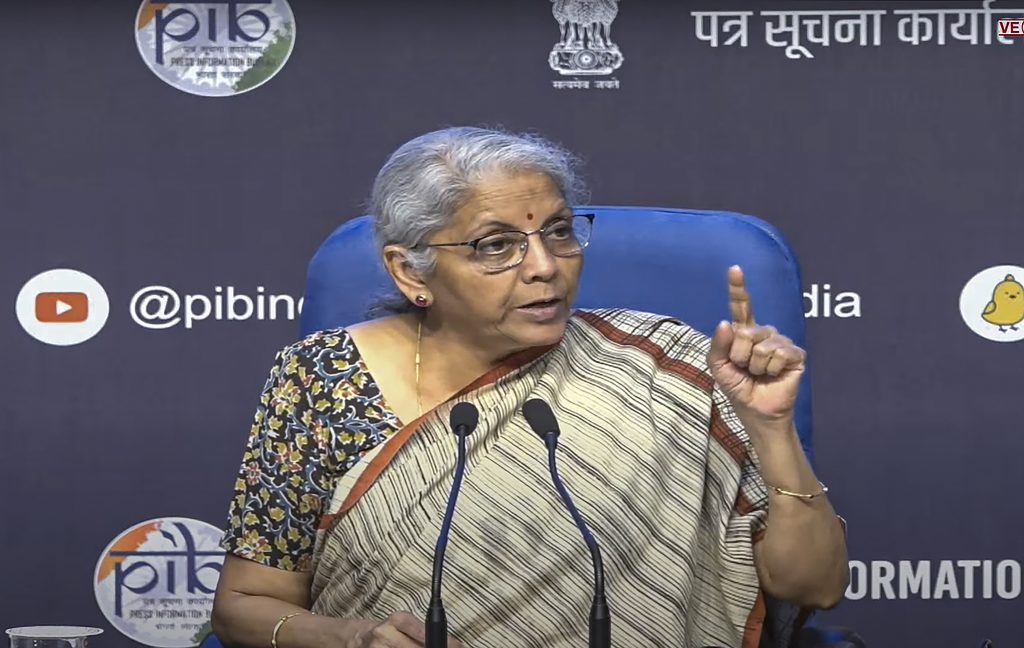

Will petrol and diesel come under GST? Finance Minister Sitharaman made a big announcement

GST Council Meeting: After the GST Council meeting, Nirmala Sitharaman said that the central government's intention is to bring petrol and diesel under the GST ambit and now the states should decide the prices together. Former Finance Minister Arun Jaitley has already proposed to include petrol and diesel in the GST Act. Now all the states have to come together to discuss and decide the price. Sitharaman said that petrol and diesel should come under GST. The aim of GST is to bring petrol and diesel under GST. Now states have to decide the price. The intention of my predecessor (Arun Jaitley) was very clear, we want petrol and diesel to come under GST. Sitharaman said that while implementing GST, the central government's intention is to bring petrol and diesel under GST after some time. He said, 'Arrangement to bring in GST has already been made. The only decision that needs to be taken now is for states to agree on the GST Council and then decide what rate to be prepared for. GST was implemented on July 1, 2017. When GST was implemented on July 1, 2017, a dozen central and state charges were added to it. However, it was decided that five items namely crude oil, natural gas, petrol, diesel and aviation fuel (ATF) would be taxed later under the GST Act. The finance minister also said that Indian Railways' facilities like platform tickets, rest rooms and waiting rooms are outside the ambit of GST and railway platform tickets are free. Apart from this, the council has given a discount of up to Rs 20,000 per person per month for accommodation services outside educational institutions, he said. He said the exemption is for students or the working class and can be availed if they stay for at least 90 days. Also Read: GST Council meeting: Platform tickets out of GST ambit, 12 per cent GST on milk cards, Finance Minister makes big announcements The post Will petrol, diesel come under GST ambit? Finance Minister Sitharaman makes a big announcement appeared first on Prabhat Khabar.