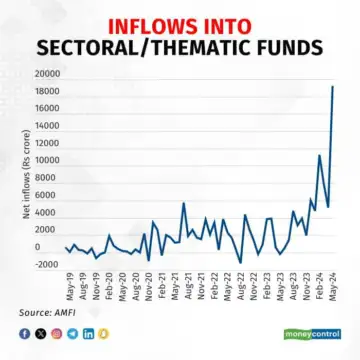

Sectoral, thematic funds investing in stocks log record inflows of Rs 19,213 crore in May: AMFI – Read

HDFC Manufacturing Fund, which was launched in May, garnered Rs 9,563 crore from investors during its new fund offer (NFO) period in the month.

The NFO for HDFC Manufacturing Fund commenced on April 26 and concluded on May 10.

HDFC Manufacturing Fund’s investment strategy emphasised on a core portfolio comprising at least 80 percent investment in stocks representing diverse sectors under the manufacturing theme.

Meanwhile, surged 83.42 percent to a record high of Rs 34,697 crore in May, according to the data released by AMFI.

As per the AMFI data, the previous record inflow into the sectoral/ thematic Fund category had stood at Rs 11,262.71 crore in February 2024. There are 162 mutual funds in this category with total assets under management (AUM) of Rs 3.37 lakh crore as of May 31.

In terms of returns, public sectors unit (PSU) was the top performing category with gains of 88.7 percent on a one-year basis. It was followed by Infrastructure, Auto, Energy & Power and Manufacturing with returns of 66.6 percent, 57.6 percent, 57.6 percent and 54.2 percent, respectively, over a one-year period.

As per rules laid out by the Securities and Exchange Board of India (Sebi), the capital market regulator, a sector or thematic fund must invest at least 80 percent of its corpus in the sector or the theme it tracks.

Sector and thematic mutual fund schemes are getting more and more popular by the day. Of all the equity-oriented and hybrid new fund offers (NFO) launched from January 1, 2023 to March 31, 2024, sector and thematic funds collected among the highest inflows, as per Value Research data.

Experts said sector and thematic funds aren’t meant for everyone. These funds should be looked at from a satellite approach, as schemes that add flavour to your portfolio. That’s because such funds pin their hopes on a single or few sectors.