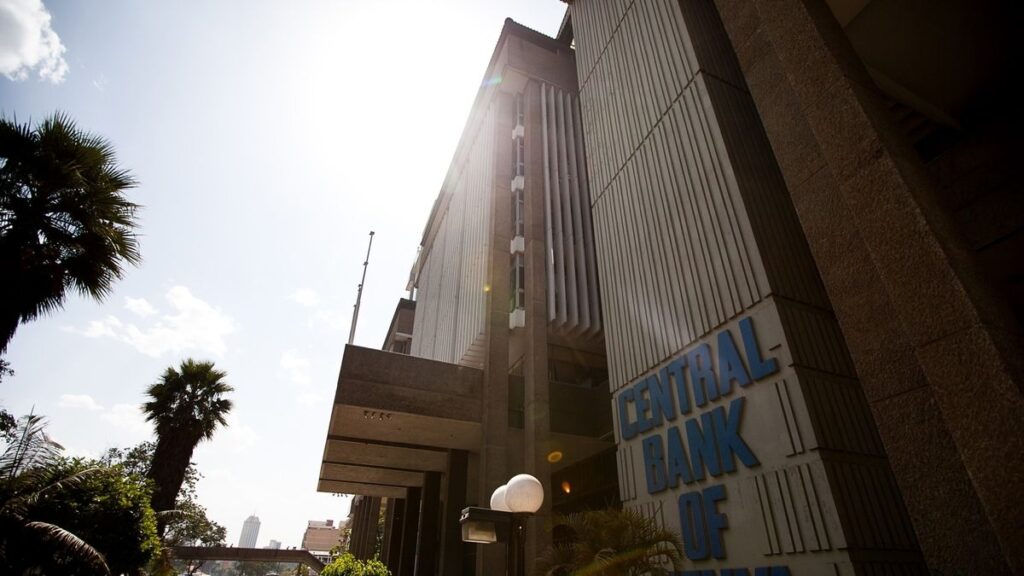

Kenya Expected to Keep Benchmark Interest Rate Unchanged at 12-Year High

Kenya is anticipated to maintain its benchmark interest rate at a 12-year high on Wednesday, allowing more time for inflationary pressures to ease before considering any adjustments to its tight monetary policy stance.

Economists predict that the monetary policy committee (MPC) will hold the key rate steady at 13% and assess inflation trends for potential future cuts.

Inflation and Exchange Rate Dynamics

Governor Kamau Thugge has emphasized the importance of inflation performance and exchange rate stability in guiding monetary policy decisions. With inflation slowing to 5.7% in the previous month and the Kenyan shilling rallying against the dollar, the central bank aims for further inflation moderation towards the 5% midpoint of its target range before considering policy relaxation.

Factors Influencing Monetary Policy Decision

The recent strengthening of the Kenyan shilling, improved weather conditions, and expectations of inflation cooling to 4.4% by year-end are factors supporting the case for maintaining the key rate. However, caution prevails amidst concerns over foreign-exchange reserves below critical levels and outstanding eurobond payments, suggesting a prudent approach to monetary policy adjustment.

Caution Amidst Foreign-Exchange Reserves and Eurobond Payments

The MPC will also be cautious about decreasing rates as foreign-exchange reserves stood at $7.09 billion as at end-March and have been below the critical level of four months’ import cover since August last year. Additionally, Kenya still needs to settle the balance of $557 million on the June 2024 eurobond, adding to the cautious stance on monetary policy adjustments.

Kenya Expected to Keep Benchmark Interest Rate Unchanged at 12-Year High#KenyaEconomy #MonetaryPolicy #Inflation #ExchangeRate #Finance #BNN

Read more: pic.twitter.com/r1JhS1I3PQ

— Emmanuel Abara Benson (@Mr_Abara) April 3, 2024