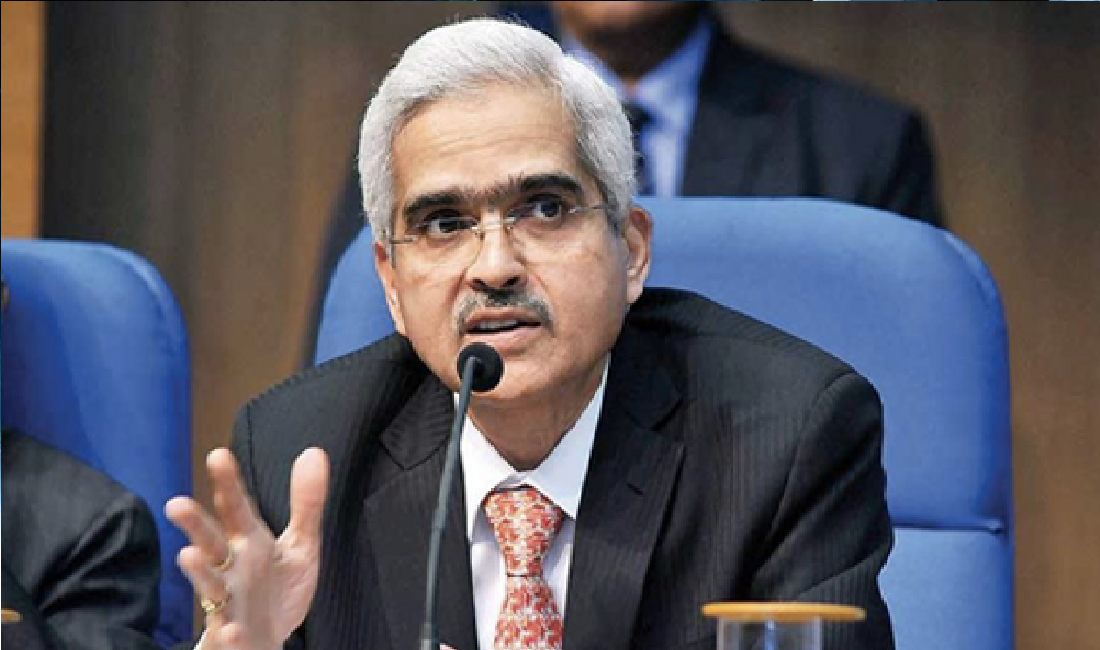

Shaktikanta Das will announce on December 6 whether RBI will cut interest rates or keep them unchanged.

RBI Repo Rate: A three-day meeting of the Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) to review interest rates began on Wednesday, December 4, 2024. Experts, economists and investors from India and abroad are watching it. There is strong debate among experts that the Reserve Bank may once again keep key interest rates unchanged at its bi-monthly monetary policy review. However, a section of experts expect interest rates to drop. In such a scenario, will RBI's Monetary Policy Committee cut interest rates or not? RBI Governor Shaktikanta Das will do so on Friday, December 6, 2024. Inflation rate crosses the limit: Experts estimate that the inflation rate in the country has crossed the upper limit set by the government. Along with this, the gross domestic product (GDP) growth figures for the second quarter of the financial year 2024-25 are very disappointing. Considering these two factors, RBI cannot make any change in interest rates. The 6-member Monetary Policy Committee (MPC) meeting, chaired by RBI Governor Shaktikanta, began on December 4-6, 2024. The outcome of the meeting will be announced on December 6. RBI may cut interest rates in February 2025 It is widely believed that the RBI will soon start cutting the key interest rate, the repo rate, but the central bank will have little choice this time. This is because retail inflation is above 6%. The RBI has maintained the repo rate at 6.5% from February 2023. Experts believe that there will be some relief only in February 2025. Impact of Global Uncertainty on Inflation and Repo Rate Given the uncertainty prevailing in the global environment and the likely impact on inflation, the repo rate is likely to remain unchanged, says Madan Sapnavis, Chief Economist, Bank of Baroda. He said there would be changes in RBI's estimates for both inflation and GDP. This is because inflation has so far been higher than RBI's third-quarter forecast and second-quarter GDP growth has been much lower than expected. Also Read: Strong start to stock markets, up 190.47 points, ICRA Chief Economist Aditi Nair says inflation rate will cross 6% in October 2024. . In such a situation, MPC in December 2024 meeting. Nair said, “We estimate that the MPC will cut its growth forecasts for the 2024-25 financial year next week. “If inflation moderates further, rates may be cut in February 2025.” Also Read: Sunil Paul Not Kidnapped, Wife Shocks The post Shaktikanta Das to announce on December 6 whether Reserve Bank will cut interest rates or keep them unchanged appeared first on Prabhat Khabar.