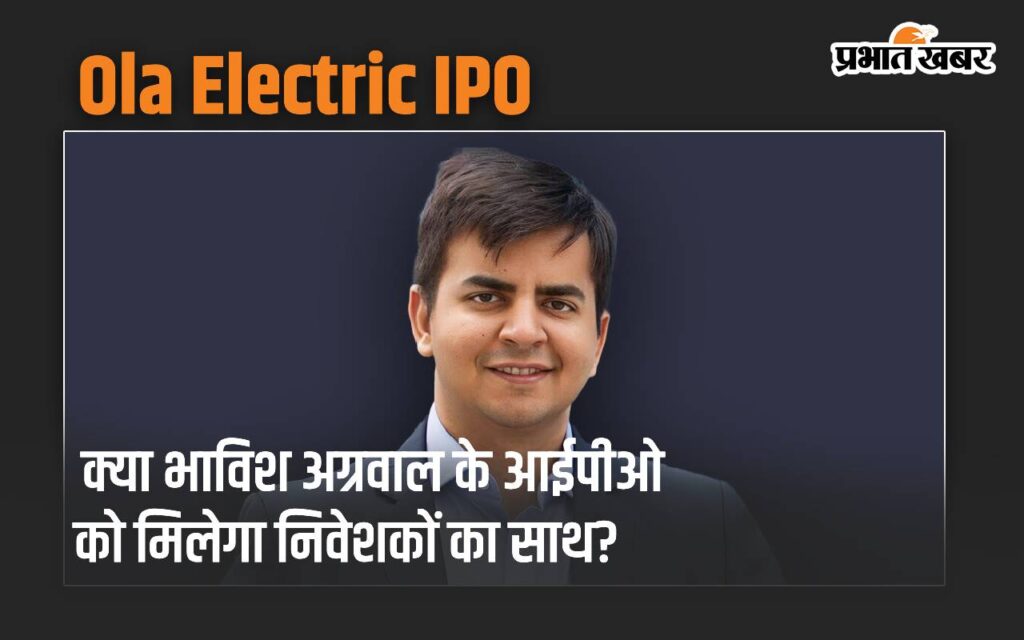

Will Pavish Agarwal’s IPO win investor support? Will find out today

Ola IPO: Pavish Agarwal’s loss-making two-wheeler maker Ola Electric’s initial public offering (IPO) will hit the market today, Friday, August 2, 2024. Launched in 2021, Ola Electric has made its mark in every household, but it is yet to turn profitable. To cut losses and improve the company’s operations, Ola Electric Chairman Pavish Aggarwal has come up with an IPO to raise money from the market. Their output is valued at Rs 6,146 crore. The company’s valuation in the high-priced group of stocks would be Rs 33,522 crore. Now the question arises whether this IPO of Pavish Agarwal will get investors’ support. Its address will be known after its subscription is opened. Assets 10 percent reserved for retail investors 3.79 crore shares to be sold in Ola’s IPO Pavish Agarwal to repay debt with IPO cash Loss-making company 10 percent reserved for retail investors According to media reports, 5500 crore shares in Ola will be sold. 100,000 worth of new shares will be issued, while 8.49 crore shares will be sold through an offer for sale. According to a report by Moneycontrol, Pavish Aggarwal has priced Ola Electric’s IPO at Rs 72-76. Investors can bid on 195 shares. Employees of the company will get a discount of Rs 7 on each share. 75 percent of the issue is reserved for qualified institutional buyers, 15 percent for non-institutional investors and 10 percent for retail investors. Ola Electric founder Pavish Aggarwal will sell 3.79 crore equity shares in Ola’s IPO, while Indus Trust will sell 41.79 lakh equity shares through the OFS. Apart from this, SVF Ostrich (DE) LLC, the largest shareholder with 21.98 per cent stake in the company, will sell 2.38 crore shares. Its partners are MacRitchie Investments PTE, Matrix Partners India Investments LLC, Techne Private Ventures and Aashna Advisors. Pavish Agarwal plans to use IPO proceeds of Rs 1,227.64 crore from the IPO proceeds for its subsidiary OCT’s cell manufacturing plant (Ola Giga Factory) to repay the loan with the IPO proceeds. Apart from this, the money raised through the new issue will be used to repay the Rs 800 crore loan taken by subsidiary OET and Rs 1600 crore for research and product development. Also Read: Interest rate: Punjab National Bank borrowing costs higher, interest rate hiked by 0.05%: According to media reports, Ola Electric continues to incur losses. Ola’s losses widened further in FY 2023-24. During the period, its net loss increased from Rs 1,472.08 crore to Rs 1,584.40 crore. Revenue rose from Rs 2,782.70 crore to Rs 5,243.27 crore during the period. Ola Electric’s business is only in electric vehicle business. Ola has so far launched around seven products in the Indian electric vehicle market. Four new people are coming. As of March 2024, Ola Electric has 870 centers and 431 service centers through an omnichannel distribution network, as per data released by the company. Also Read: Gold again loses control, silver at Rs. 600 up The post Will Pavish Agarwal’s IPO get investor support? It will be known today appeared first on Prabhat Kabar.