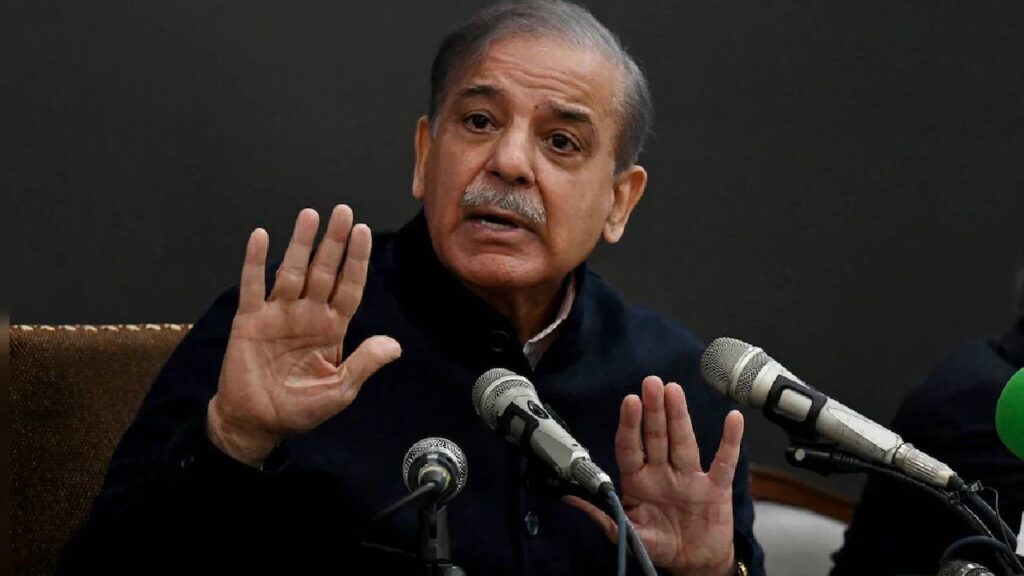

What to do, there is no way! IMF has put such conditions for giving money to Pakistan that PM Sharif was shocked to hear them

Pakistan News: Talks between Pakistan and International Monetary Fund officials ended without resolving any issue. Pakistan, which is facing an economic crisis, needs financial assistance for immediate relief.

Pakistan News: The entire world is aware of the economic condition of Pakistan. Pakistan is gasping under the burden of debt. Its rulers are trying hard to get relief from every place. At one time, Pakistan seemed to be getting relief from the International Monetary Fund (IMF), but now it has also given up. In such a situation, Pakistan has suffered a big setback. The meeting between Pakistan and IMF officials remained inconclusive. In this discussion, consensus could not be reached on issues like income tax rates, health and agriculture. Due to this, IMF stopped its talks with Pakistan officials.

Inflation in Pakistan is at its peak. In such a situation, the Pakistani government is considering levying 45 percent tax on salaried and non-salaried taxpayers. This tax is being considered on those people whose monthly income is more than Rs 4.67 lakh. In Pakistan, a rule of paying 35 percent tax on monthly income of more than Rs 5 lakh is already in force.

Pak government gave the proposal

Since the International Monetary Fund is not showing any leniency towards its conditions, if the coalition government of Pakistan accepts its conditions, then it is certain that it will have an impact on the people of the country. The government may also have to face the terrible anger of the people. The IMF is putting pressure on Pakistan to increase the tax on exporters in the next budget. According to the report, the Pakistani government has agreed to accept this condition. This year, exporters have sent 86 billion rupees to Pakistan. This is 280 percent less than the tax on salaried employees. To convince the IMF, the Pakistani government has also offered to impose tax on pension.

What does the IMF want?

The Pak government is ready to increase the tax rate on non-salaried people by 45 percent to accept the conditions of the IMF, but it wants to keep salaried people out of this rate. The government believes that non-salaried people pay tax except business expenses, whereas salaried taxpayers pay tax on their entire income. The Pak PM is opposing the increase in tax on salaried people. The IMF also wants a higher tax rate on low-income people, which the Pak government is refusing to accept.