Experts worry that a delay in interest rate cuts in the US is now imminent – News India Live – ..

US Federal Reserve Chairman Jerome Powell said late on Tuesday that progress in meeting the inflation target so far this year has not been good. Experts interpret this statement to mean that there will be no reduction in the current high interest rates until the inflation rate in America reaches close to its set target of 2 percent.

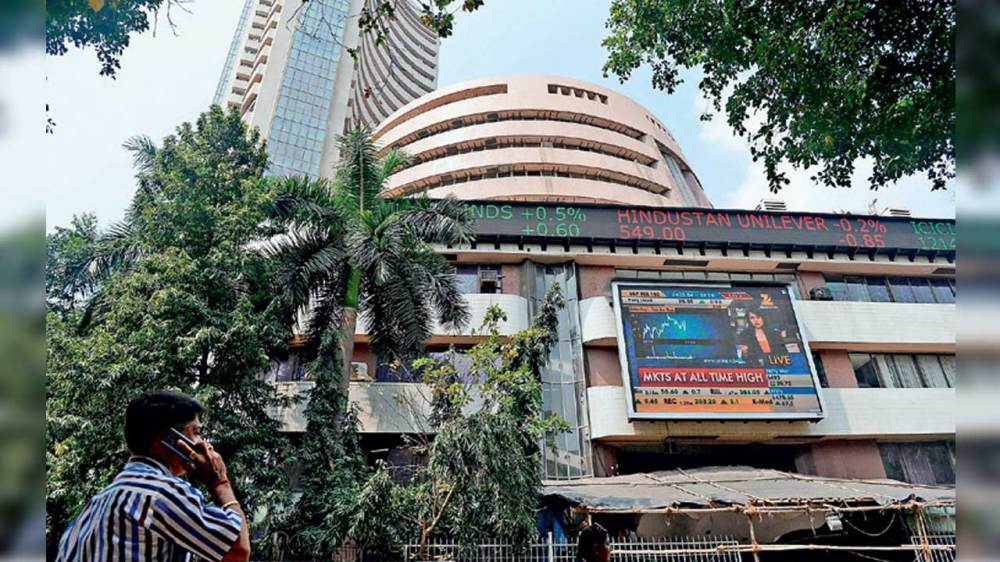

For three consecutive months, the inflation rate in America has been higher than experts’ expectations. Therefore Powell also said that interest rates will remain high as long as necessary. Inflation in the US rose to 3.5 percent year-on-year in March, more than the 3.4 percent expected by experts. While polling on what effect such a statement by the US Federal Reserve will have on the Indian stock market, experts say that this statement may intensify the selling in the Indian stock market. Indian stock markets fell soon after US inflation came in higher than expected in March. The delay in interest rate cut, especially in the US, could have an impact on Indian IT stocks. In the last three sessions alone, a decline of about 5 percent has been seen in the IT index, for which this factor is also responsible. On the other hand, increasing tension in the Middle East and selling by FIIs may also increase the recession in the market. In the last three sessions alone, FIIA in the Indian stock market has traded worth Rs. Net sales of Rs 18,000 crore. Due to this low, the Indian Rupee has also fallen to its historical low. Considering all these factors, it will not be surprising if the recession continues in the Indian stock market.

Advance drawdown ratio in first 12 days of April at 1.31

With the start of the new financial year, both the benchmark indices of the Indian stock market hit new record highs in the month of April. M cap is also Rs. Crossed Rs 400 lakh crore. Another good sign was that the advance drawdown ratio of Indian stock markets also stood at 1.31 in the month till April 12, compared to 0.83 in March, 2024. However, after April 12, the market’s breathing has become weak and this ratio has taken a U-turn and started decreasing. As geopolitical tensions in the Middle East eased, the Sensex fell 850 points on April 15, with only one gain against four declines, meaning the advance drawdown ratio came down to 0.25. However, on the question of whether the fact that the ratio remained at a good level in the last 12 days is a good sign, experts say there was sharp selling in mid-cap and small-cap stocks following the concerns expressed by SEBI. Was. in March. After this, in the first 12 days of the month of April, this ratio reached the level of 1.31, due to which the decline was compensated by the increase. This is indeed a good sign, but the situation now depends on whether the situation between Iran and Israel escalates or improves. Therefore, only time will tell whether this ratio will be able to maintain its level in the future or not.